nc estimated tax payment calculator

File Pay Taxes Forms Taxes Forms. Youll file a 1040 or 1040 SR to report your Social Security and Medicare taxes.

![]()

Self Employment Tax Calculator Estimate Your 1099 Taxes Jackson Hewitt

The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here.

. This calculator is designed to estimate the county vehicle property tax for your vehicle. Filing quarterly taxes. Please enter the following information to view an estimated property tax.

In 2013 the North Carolina Tax Simplification and Reduction Act radically changed the way the state collected taxes. Estimate Federal Income Tax for 2020 2019 2018 2017 2016 2015 and 2014 from IRS tax rate schedules. Each payment of estimated tax must be accompanied by Form NC-40 North Carolina Individual Estimated Income Tax.

Launched and Powered by GCA Mortgage the North Carolina Mortgage Calculator is the best user-friendly mortgage calculator. There is a variation on lottery tax on winnings according to country policy for. The North Carolina General Statutes provide both civil and criminal penalties for failure to comply with the income tax laws.

Is not used to calculate the installments of estimated tax due. Individual income tax refund inquiries. File Pay Taxes Forms Taxes Forms.

Interest on the underpayment of estimated income tax is computed on Form D-422. 46385 plus 35 of the amount over 209400. First calculate your adjusted gross income from self-employment for the year.

Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Calculate net income after taxes. Your household income location filing status and number of personal exemptions.

Income Tax Calculator Estimate Your Refund In Seconds For Free. April 15th payment 1 June 15th payment 2 September 15th payment 3. North Carolina Department of Revenue.

Lottery Tax Calculator calculates the lump sum payments taxes on the lottery and tries to provide accurate data to the user. If you payment is late calculate the amount of penalty due and include it on Form D-400 Line 26b. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan.

Paying taxes as a 1099 worker. Calculate net income after taxes. North Carolina Estate Tax.

In North Carolina both long- and short-term capital gains are treated as regular income which means the 525 flat income tax rate applies. I am filing as a non-resident. To make the easy calculation for lump-sum lottery taxes state-wise in the USA and country-wise for the rest of the world.

ICalculator aims to make calculating your Federal and State taxes and Medicare as simple as possible. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. PO Box 25000 Raleigh NC 27640-0640.

North Carolinas statewide gas tax is 3610 cents per gallon for both regular and diesel. Please refer to Publication 505 Tax Withholding and Estimated Tax PDF for additional. North Carolina repealed its estate tax in 2013.

How Income Taxes Are Calculated. Link is external To pay individual estimated income tax. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Our online Annual tax calculator will automatically. This is my first year filing a NC State return. To use our North Carolina Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

There is a variation on lottery tax on winnings according to country policy for lottery winners. The estimated tax you will pay. 2022 NC-40 Individual Estimated Income Tax.

156355 plus 37 of the amount over 523600. Which bracket you land in. The calculator should not be used to determine your actual tax bill.

Your county vehicle property tax due may be higher or lower depending on other factors. Home File Pay Taxes Forms Taxes Forms. PO Box 25000 Raleigh NC 27640-0640.

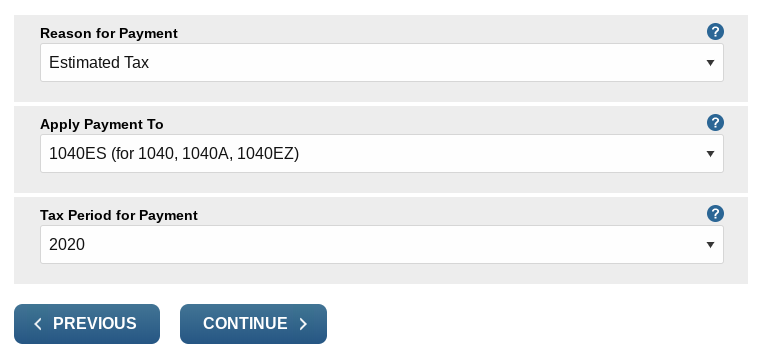

Pay individual estimated income tax. Once youve used our estimated tax calculator to figure out how much you owe making the payment is fairly straightforward and takes less than 15 minutes. City Income Tax Return For Individuals Spreadsheet Tax Return Income Tax Income Tax Return.

The more common penalties are. Nc estimated tax payment calculator. Schedule payments up to 60 days in advance.

Nc estimated tax payment calculator. North Carolina Gas Tax. How To Calculate Payroll Taxes Methods Examples More Created with Highcharts 607.

There is no other mortgage calculator that is as accurate as GCAs. You can also pay your estimated tax online. I live in VA and work in NC In performing my tax review the software flagged my estimated tax payments bc I checked 1a and 3a on the estimated tax worksheet.

Use the Create Form button located below to generate the printable form. Lottery Tax Calculator calculates the lump sum payments taxes on the lottery and tries to provide accurate data to the user. You can calculate how much your monthly mortgage payment is with PMI property tax and insurance using the North Carolina Mortgage Calculator.

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download. After a few seconds you will be provided with a full breakdown of the tax you are paying. The act went into full effect in 2014 but before then North Carolina had a three-bracket progressive income tax system with rates ranging from 6 to 775.

Individual Income Tax Sales and Use Tax Withholding Tax. For details visit wwwncdorgov and search for online file and pay For calendar year filers estimated payments are due April 15 June 15 and September 15 of the taxable year and. 7 Mail the completed estimated income tax form NC-40 with your.

Contact your county tax. Enter Your Information Below Then Click on Create Form to Create the Personalized Form NC-40 Individual Estimated Income Tax. Individual Income Tax Sales and Use Tax Withholding Tax.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Enter Your Status Income Deductions and Credits and Estimate Your Total. 2020 Extended Due Date of First Estimated Tax Payment.

Youll need to make the payments four times per year according to these due dates. As a 1099 earner youll have to deal with self-employment tax which is basically just how you pay FICA taxes. Pursuant to Notice 2020-18 PDF the due date for your first estimated tax payment was automatically postponed from April 15 2020.

The combined tax rate is 153. Make one payment or. After a few seconds you will be provided with a full breakdown of the tax you are paying.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs. The more deductions you find the less youll have to pay Use the IRSs Form 1040-ES as a worksheet to determine your estimated tax payments.

Click here for help if the form does not appear after you click create form. Normally the 153 rate is split half-and-half between employers and employees. The tax rate cuts will disproportionately help the richest earners.

PO Box 25000 Raleigh NC 27640-0640. Find your total tax as a percentage of your taxable income. North Carolina Department of Revenue.

Tax Calculator Estimate Your Taxes And Refund For Free

Paycheck Calculator Take Home Pay Calculator

Quarterly Tax Calculator Calculate Estimated Taxes

Property Tax How To Calculate Local Considerations

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

How Much Should I Set Aside For Taxes 1099

Quarterly Tax Calculator Calculate Estimated Taxes

Quarterly Tax Calculator Calculate Estimated Taxes

Capital Gain Tax Calculator 2022 2021

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

Paycheck Calculator Take Home Pay Calculator

Llc Tax Calculator Definitive Small Business Tax Estimator

Income Tax Calculator 2021 2022 Estimate Return Refund

Tax Day And Extension Options Nextadvisor With Time

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

Simple Tax Refund Calculator Or Determine If You Ll Owe

Calculating Federal Taxes And Take Home Pay Video Khan Academy